As a rule, in terms of income taxes, most people don’t realize why they have to hire a professional. The the facts clearly shows that ever since you don’t have expertise in a particular area, the likelihood of achieving success are nearly inexistent. The legal sector is very complex, meaning that not every person could have to deal with the different situations which entail precise expertise in the regulations and conditions. It’s factual that when you start a specific thing by yourself, it helps save from supplemental expenditures, but it is far from the truth if you don’t understand what it implies to manage taxes. An not prepared engagement may bring undesirable circumstances. Precisely what is seen at first sight can differ so much from real life. That’s why, if so far you were assured that you can handle it on your own with no any earlier expertise, it’s the right time to change your strategies. For starters, you must understand that having a Tax Adviser will not be an additional expenditure. Most of the people get to realize this only after an not successful personal experience, which you undoubtedly do not want.

Having and managing a organization entails a great deal of hard work. Everyone seems to be concentrated towards achieving success, but dealing with specific stages can make work even more complicated. This is the scenario when you take on the role of tax processing without having sufficient knowledge. Even though the need to carry out specific jobs privately begins from a commendable justification to save resources, you are able to still begin to realize that disproportionate saving goes to another, obviously bad extreme. Operating a business demands the involvement of some key people, and tax return preparers are among them. So, as you realize that taxes are not your area of expert knowledge, essentially the most fair move to make is always to look for the expertise of your own tax specialist. Financial integrity is not just about great business enterprise – companies of all sizes are on target. Long term success requires a approach but as well as confidence that the financial circumstances is good. The team, irrespective of how compact it can be, when it is composed of the appropriate people, just isn’t possible it will not be successful in the projected targets. Make time to analyze the situation and that can save you from quite a lot of pointless potential risks.

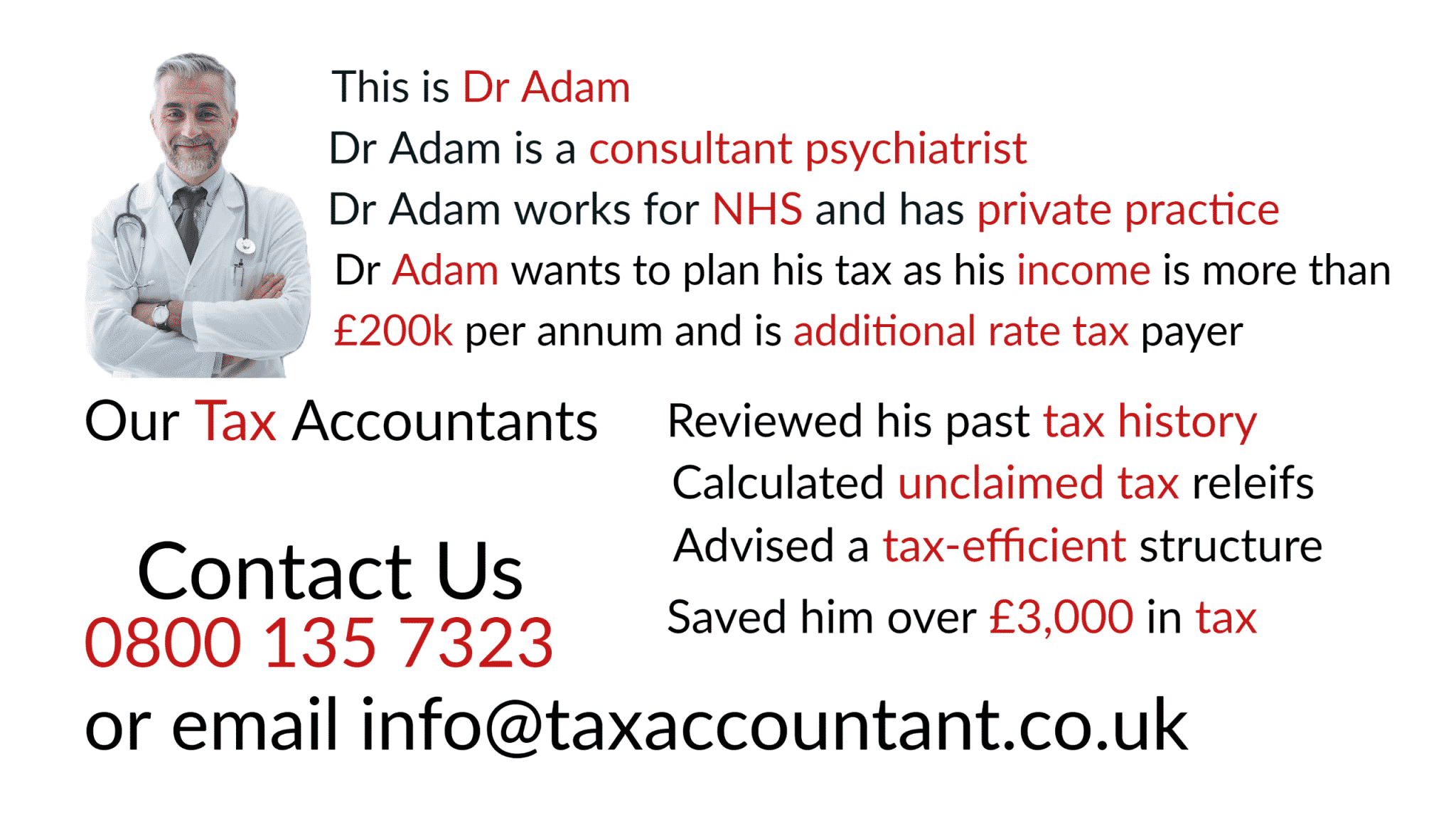

You can actually go to the search solution of Accountancy firm near me or check out taxaccountant.co.uk for more information. Precisely what remains to be very important would be the fact working with a tax accountant is a smart judgement.

For details about Accountant UK take a look at our website: click for info